Bloodbath. The markets are being severely impacted. As a result of Jerome Powell’s statement that interest rates will rise and remain high for a longer period of time, the US economy will experience “some pain.”

The markets have swiftly returned to the inflation narrative. The recession narrative boosted markets as investors began to wager on a Fed reversal. That interest rates would be declining.

Being a bull on precious metals in this environment could be deemed insane. The US dollar is continuing to increase and is likely to do so for the foreseeable future as investors rush to cash and international investors seek the protection of the US dollar. Gold and silver have a strong inverse negative association with the U.S. currency. Gold falls when the dollar rises and vice versa.

If interest rates continue to rise, gold prices will stay under pressure. However, knowing that future bonds will yield more, would you still purchase bonds if rates are rising? In actual terms, after accounting for inflation, you would still be losing money on bond yields.

When individuals lose faith in the government, central banks, and the fiat currency, they invest in gold. Gold has been money for centuries, and regardless of what happens to a country, be it war or a new regime, gold remains money in the new order.

There are numerous reasons why the theme should be wealth preservation, as I observe the globe. Geopolitics, inflation, the energy issue in Europe, which will start to make headlines in a few months, agriculture and drought, central banks breaking the system with rate hikes, and a mainly indebted consumer and middle class are all major concerns. The list is exhaustive. The idea is that money will flow into the U.S. dollar, but I believe this assertion is flawed.

Brent Johnson discusses the Currency Milkshake Theory and how a surging US dollar will destabilize the global economy. This has already occurred with the Turkish Lira, Japanese Yen, and possibly the Hong Kong Dollar. What will the rest of the world do if the dollar grows too strong? Especially those emerging markets with substantial debt denominated in dollars. The increasing dollar has significantly increased the cost of debt. Anyone for Bretton Woods/Plaza Accord 2.0? The Fed and the United States may be obliged to weaken the currency if a stronger dollar continues to create havoc, but this will not occur tomorrow. This is exactly what I foresee happening in the future.

Betting on gold is a wager on the system becoming stressed. This may sound like the ramblings of a conspiracy theorist, but billionaire Ray Dalio has been forewarning us of this moment (crash is trash!) for some time. Central banks and fiat money will be examined. Dalio is a gold bull.

Despite the market’s devastation, some gold equities are performing rather well. Gold juniors have smaller market capitalizations, and all it takes for the company to outperform is a press release.

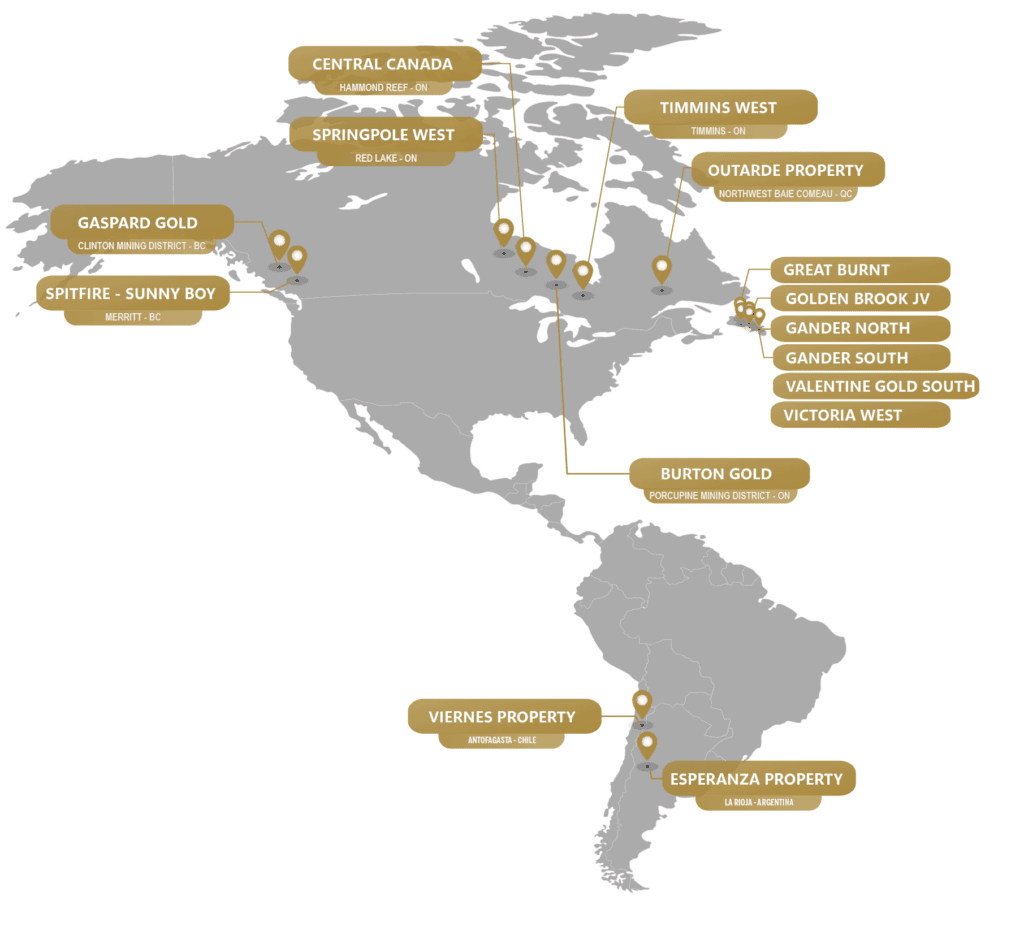

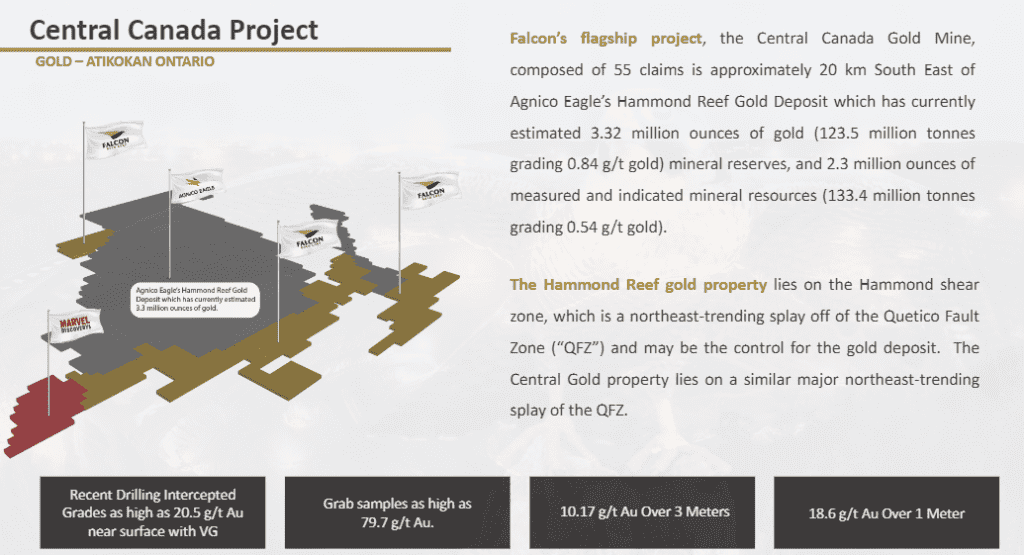

Falcon Gold (FG.V) is on CEOdigest radar screen. Falcon Gold is a junior explorer in the Americas that acquires, explores, and progresses high-quality mining properties. Their holdings are located in Canada, Chile, and Argentina, with their flagship project being in Central Canada, adjacent to Agnico Eagle Mines’ Hammond Reef deposit, which has 4.6 million ounces.

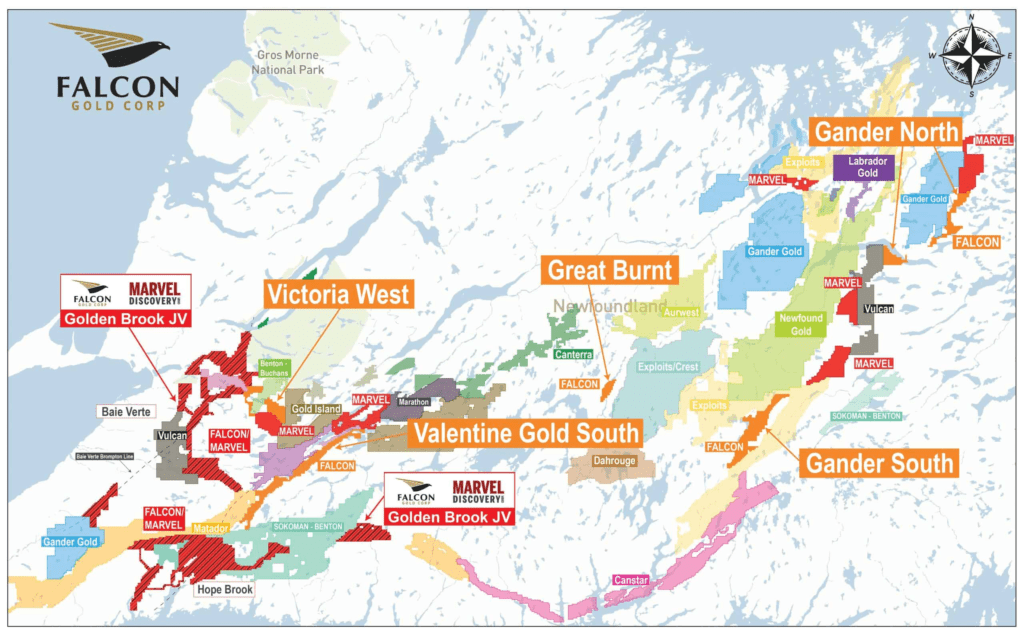

Recently, the company has been focusing on Newfoundland.

The above-described Newfoundland property portfolio of Falcon is enormous. Falcon has bought and presently possesses about 140,000 hectares of land in Central Newfoundland that is attached to major structures. This places Falcon Gold among the top eight percent of landowners in the province. There are no property payments or net smelter royalties on the majority of their holdings in Newfoundland. This positions Falcon favorably for future success when new discoveries are made.

We have employed the phrase “close-ology.” Due to the proximity of Falcon’s holdings to large structures (and even active or defunct mines in other Provinces), the likelihood of discovery is increased as the vein could extend into Falcon’s land holdings. Falcon must drill, discover, mitigate risk, and then find a buyer.

Several of you may wonder why Newfoundland? The province in Canada has attracted mining magnates. Eric Sprott, the billionaire investor and founder of Sprott Asset Management, is one such mogul. Since then, Sprott has invested substantially in Central Newfoundland, holding over 125.9 million shares of New Found Gold. Sprott has invested over $200 million in New Found Gold Corp., raising his total ownership to over 30%. This is his largest wager to date, and he believes Newfoundland may contain the “greatest gold discovery in Canadian history.”

Falcon Gold crews mobilized in Newfoundland for numerous projects. The initial phase of exploration at Gander North, which comprised baseline prospecting, soil sampling, and trenching, has been completed. An upcoming catalyst for the stock will be news of exploration progress. Recently, Falcon closed on a $300,000 CAD financing. The proceeds will be utilized for basic working capital and ground exploration.

I believe that one of the most intriguing projects is the Central Canada project. It is geographically adjacent to Agnico Eagle’s Hammond Reef project. Falcon Gold has located gold after doing drilling. To expand and uncover a discovery, additional drilling is required, and I believe it would be fantastic if Falcon conducted a drilling program or maybe a joint venture. But perhaps this is for the future, with Newfoundland as the focal point.

And what about the properties in South America? Falcon Gold delivered a corporate update on August 2, 2022, and CEO Karim Rayani reaffirmed his commitment to creating shareholder value. The plan for a spin off is something that will be advantageous for shareholders. Falcon Gold plans to transfer its rights, obligations, and interest in the Esperanza Gold project in Argentina to its wholly-owned subsidiary Latamark Resources Corp.

Using a plan of arrangement, the deal is being finalized. According to the agreement, Falcon shareholders will receive one common share in Latamark for every 5.8 shares held in the company as of the arrangement’s effective date. The anticipated record date is early September 2022.

The advantages? It safeguards share capitalization and necessary capital expenditures, permitting Falcon Gold to concentrate on Canadian operations while Latamark concentrates on possibilities and initiatives outside of North America.

The acquisition of Green Metals on June 6, 2022, which gave Falcon two battery metal-focused projects in Canada, and updates on the Viernes project in Northern Chile were also noted by Karim Rayani during the company’s busy summer.

Technically, Falcon Gold’s price rebounded nicely in the $0.075 region. What I liked most about the wedge design I drew was the break in the pattern. After the intermission, we made a bold move. The huge candle you see is the market’s response to the Falcon corporate update press release issued on August 2, 2022. The market enjoyed both the material and the spin-off news. The news was received in great quantity. This is the highest volume of shares traded since March 31, 2022.

The significant resistance zone (price ceiling) is located at $0.125. On August 2, 2022, we actually broke above it, but we failed to close above it. If so, it would have been a significant and bullish technical development. The stock has remained below this level despite many attempts to surpass it. This is the break we want to see in the long run, and it would result in a technical increase to $0.25.

What about the present? Well, the markets are falling, and the dollar’s strength is exerting some pressure on gold. As previously noted, the dollar may be reverting as it encounters resistance. If this occurs, the price of gold and Falcon Gold may rise. Will it be sufficient to close over $0.125? I believe sustained momentum above $0.125 would require either a huge news announcement from Falcon Gold or gold to climb back above $1800.

If market and gold weakness persist, it is realistic to expect a price decline to the $0.075 area. Major support was retested, and I anticipate that buyers will be coming up to purchase shares. However, this remains to be seen.

With a current market capitalization of $11.07 million, Falcon Gold has substantial upside potential based on its fundamentals and technicals.