2022-01-25 11:11:00

Dennis Diatel Photography/iStock Editorial via Getty Images

Introduction

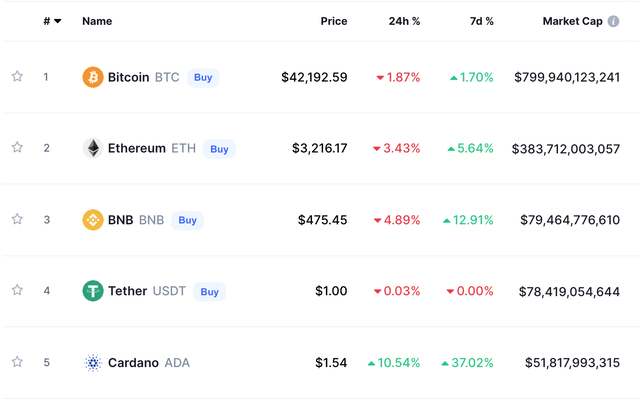

For many in the cryptocurrency community, Cardano (ADA-USD) is a joke. Critics say the blockchain is nothing more than vaporware due to its lack of utility. Those investors could not be further from the truth. Cardano is on the brink of a decentralized app (DAPP) explosion. The blockchain is backed by extensive research, great tokenomics, a simple staking model, and has the benefits of being an eUTXO chain. Also, the coin is historically cheap, lowering the risk of buying too high. I believe investing in ADA has the best risk-reward due to the overly-bearish attitudes of the crypto community. Below are 6 reasons why I continue to buy ADA on this dip and urge other investors to do the same.

Criticism of Cardano

Cardano’s criticism can be organized into three main points. First, the blockchain cannot handle transactions from its current user base. After SundaeSwap deployed it congested the blockchain and the protocol listed transaction delays of up to 16 hours. Next, smart contracts were supposed to come out for a long time and were continuously delayed, instilling distrust in investors. Lastly, Cardano is a research project that overly focuses on theory and ignores utility. This means that investors cannot invest in projects as they do not exist. This criticism comes from investors in the other “Ethereum-killer” blockchains such as Solana, Avalanche, and Harmony One. These coins share a similar goal with Cardano as being a fast and cheap alternative to Ethereum.

1. Historically Cheap

Cardano has the potential to be one of the most influential blockchains in the industry, and the market is not reflecting that. ADA entered a downtrend following the highly-anticipated Alonzo hard fork that finally brought smart contract capabilities to the blockchain. Following the upgrade, ADA gradually dropped 62% because investors were overly-optimistic expecting dapps to be immediately released. To their surprise, it would take more time for dapps to deploy on the ecosystem due to concurrency issues. Recently, developers seem to have found the fix for the problem. Founder, Charles Hoskinson, mentioned that there are 127 projects in development and many will be released in the first half of 2022. Leading decentralized exchange (DEX) SundaeSwap already launched last Thursday. ADA is cheap and its utility is increasing with the deployment of dapps. This makes the coin a good buy.

TradingView ADA/USDT

2. Peer-reviewed and Secure

Cardano is one of the best candidates for institutional adoption because of its strategy of careful development. Dubbed the “measure twice cut once” approach, all of the changes to the blockchain are peer-reviewed before deployment. Decrypt.co explains it best, “all changes and new features introduced are developed, reviewed and agreed upon by academics before being used”. This provides peace of mind to users that their funds are protected. According to Crystal Blockchain, $4.25 billion of crypto assets were stolen through fraud and breaches in 2021. This deters new investors and institutions from entering the market. If Cardano can prove itself as safe it would appeal to institutions and take market share from its competitors.

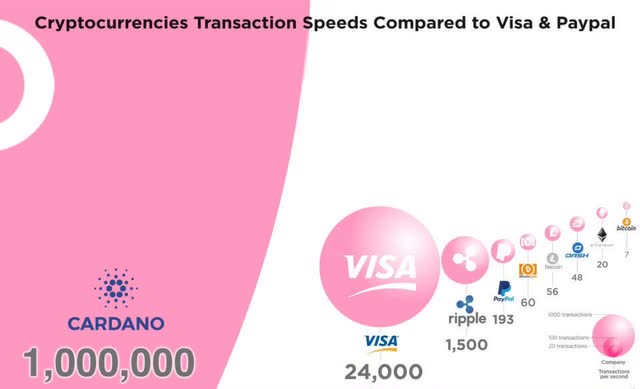

3. Hydra Scaling Solution

Hydra will improve scalability across the network to make Cardano the fastest blockchain in existence. This will be done by implementing off-chain transactions. This layer-2 scaling solution would process many transactions off-chain before settling the results on the main chain. Batching the transactions lowers fees and increases transaction speeds. Upwards of 1 million transactions per second can be achieved with Hydra after full implementation, bringing more utility to the Cardano ecosystem.

4. Staking is Easy

One of the greatest benefits of owning ADA is staking. Cardano is a proof of stake blockchain, so users can delegate ADA to decentralize the network and get paid tokens. After approximately 15 days (3 epochs) users earn rewards of ~5% APY. There is no lock-up period so users can immediately move their assets. Users also retain full control of their private keys so they don’t have to worry about exposing their ADA to hackers. After creating a software wallet, investors can transfer their coins from an exchange and delegate it using the wallet’s interface. This makes the Cardano delegation system the easiest for new users.

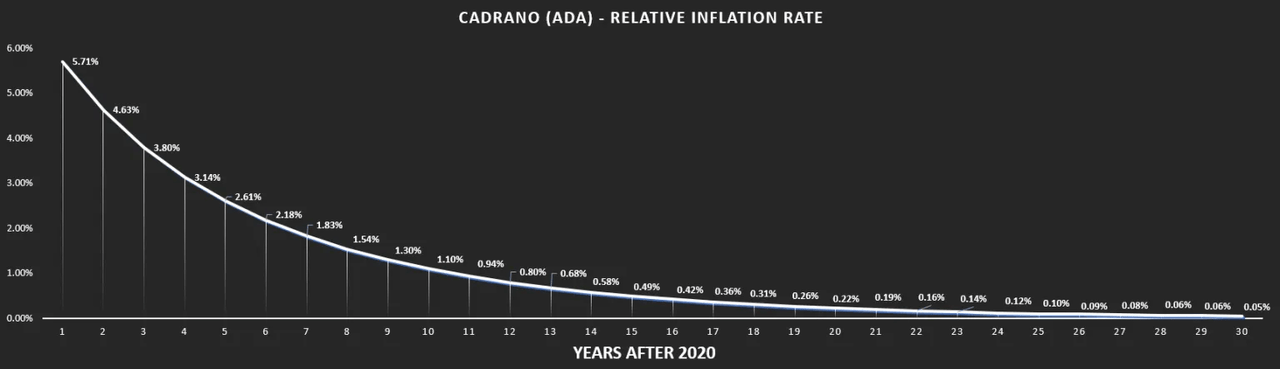

5. Sound Tokenomics

ADA’s tokenomics protect users from inflation. The max supply of ADA is 45 billion and the total supply is 34 billion. That means 75.5% of ADA’s max supply has been minted. Solberg Invest calculated that the inflation rate is currently 5.7%, and inflation is exponentially decreasing every year. Additionally, as keys are lost it will remove tokens from the circulating supply. While 5.7% may seem high, delegators experience 0.7% inflation after adding rewards. With the ease of staking, it is in an investor’s best interest to stake. Investors are still being diluted slightly, but they are performing better than other currencies.

Solberg Invest

How Does this Compare to the U.S. Dollar and Bitcoin?

The US dollar is inflating at a higher rate than ADA. The Bureau of Labor Statistics reported that the Consumer Price Index (CPI) rose 7% in December 2021 compared to 2020. This means USD investments need to yield at least 6.3% to keep up with ADA delegators. ADA has the advantage of retaining more value than dollars. However, in the crypto world, it’s not special to outpace fiat currency. It’s important to also compare ADA to its peers.

Bitcoin is inflating less than ADA at a rate of 1.75% per year, but delegators are still outperforming Bitcoin’s inflation. Bitcoin holders need to get at least a 1.05% return on their investment to keep up with delegators. This is easy for a technologically savvy crypto investor willing to take risks, but Cardano’s staking system is much safer and easier to use. This is why investors staking their ADA are getting the best reward for their limited risk.

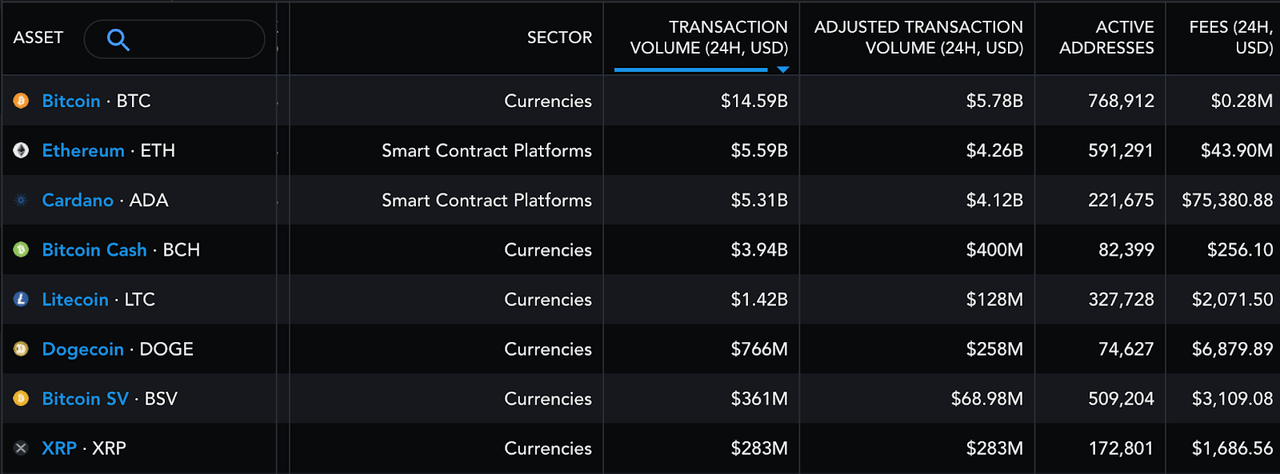

6. eUTXO Advantage

Cardano’s eUTXO (extended unspent transaction output) model has two clear advantages over Ethereum’s account model. One, the eUTXO model allows users to check transactions to see if they will succeed before they are sent. There are no worries about spending unnecessary transaction fees just to see a transaction get stuck. Also, the fees can be calculated before the transaction is sent, so there is no need to guess how much is acceptable. Two, if the same inputs are not used, an eUTXO model allows for more transactions to be done in parallel. This allows for more efficient transactions. Cardano is already number 3 for transaction volume and the fees are only $75,000 compared to Ethereum’s $44 million. If the Cardano ecosystem can use the eUTXO system to its full potential, it could cover the shortcomings of account-model blockchains and make transactions faster and cheaper.

Risks

Concurrency

Cardano DeFi (decentralized finance) protocols need to solve how they will manage eUTXO flow. The core issue is that when multiple users are interacting with the same inputs, they have to queue. When dapps are released it is likely the blockchain will not be able to quickly service all of the users. With over 2.5 million users, the transaction delays might last days. Competitor blockchain, Avalanche, crashed after a launch of a popular dapp called Pangolin and that blockchain uses an account model. Protocols have been constantly delaying their release to prepare for the rush of users. It should not be a surprise that the blockchain will be congested when dapps deploy and developers are trying to prepare for the influx of users.

Late Entry to Market

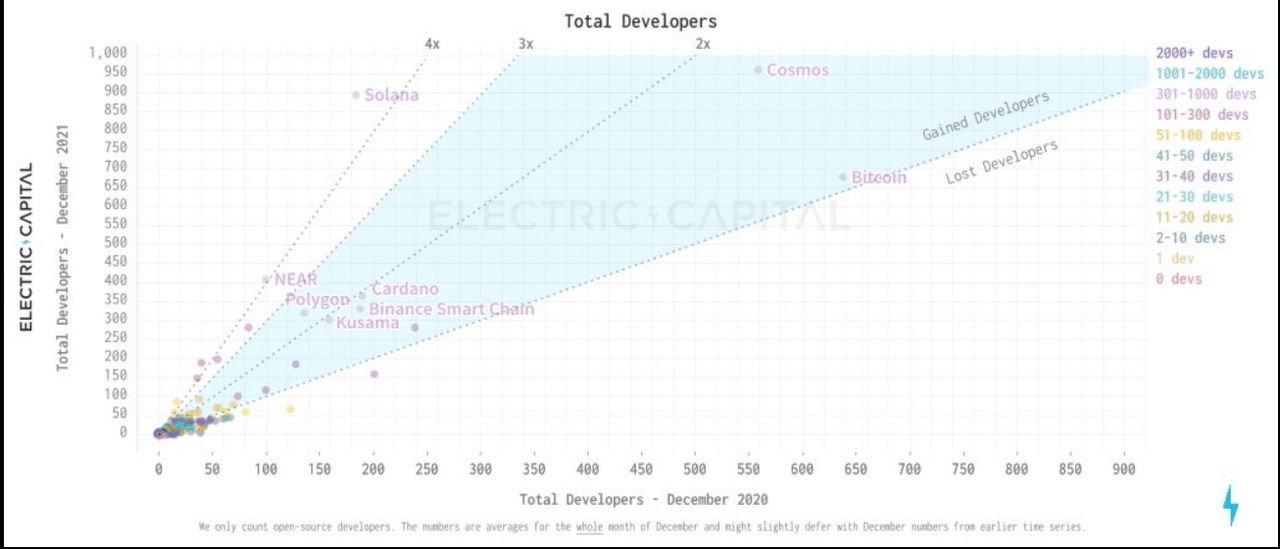

Since Cardano focuses on a slower approach to developing a better product, the blockchain is missing out on the first-mover advantage. Ethereum has been around since 2015 and has the largest total value locked with 62.54%. Since Ethereum was released the earliest, the ecosystem has the most developers with 3,920 developers. Although Cardano’s developer size grew about 90% from December 2020, Cardano has only about 360 developers. In the Harvard Business Review’s The Half-Truth of First-Mover Advantage, research shows that in industries with high technological innovation and evolving markets it is very difficult to get a durable first-mover advantage. Cardano did miss out on an early entry, but if the technology is innovative, it could overtake Ethereum in the future.

Fed Rate Increases

The Federal bank has been propping up markets since the start of the pandemic. If the central bank decides to increase rates and reduce asset purchases as Goldman Sachs predicts, investors could see a pullback in the equity and crypto markets. This is because institutions and retail investors will move their money into more risk-averse assets. Due to the nature of cryptocurrencies, they should receive most of the damage, in theory. It is hard to predict how much the markets drop, or if it is already priced in, but investors should keep this key macroeconomic factor in mind when investing in ADA.

Price Target

Cryptocurrencies are notoriously difficult to value since the industry is new. So the only way to make a reasonable estimate is to compare ADA’s market cap with other currencies. I believe that ADA will return to the top three cryptocurrencies by market cap behind Bitcoin and Ether. This implies that ADA will reach $2.50. In addition, if Cardano has successful dapp launches and Hydra proves to be a sufficient scaling solution, I could see the price reaching 33% of Ethereum’s market cap. This would value the coin at $3.75. Keep in mind the crypto market is very volatile. It’s important to have conviction, but do not invest more than you are comfortable losing.

Conclusion

While many feel that Cardano’s technology will be nothing more than vaporware, I have outlined reasons why that is not the case. In this quarter investors will see the first wave of dapp deployments in the ecosystem. These pioneers are the first glimpse into what Cardano has to offer. In the market, slow development is not attractive when users are reaching for the next 10x. However, it will attract users to the network in the long run. Patient investors should take advantage of the overly-bearish attitude towards the Cardano network by buying ADA.