2022-02-04 14:18:06

Edmonton, Alberta–(Newsfile Corp. – February 4, 2022) – Benchmark Metals Inc. (TSXV: BNCH) (OTCQX: BNCHF) (WKN: A2JM2X) (the “Company” or “Benchmark“) is pleased to announce new results from 7 infill and expansion drill holes from the northern portion of the Cliff Creek deposit (Cliff Creek North – CCN). Drilling has yielded broad zones of bulk-tonnage and high-grade mineralization. The intersections continue to define zones of high-grade bulk tonnage including 30.48 metres (m) core length of 8.96 grams per tonne (g/t) gold and 233.04 g/t silver or 11.87 g/t gold equivalent (AuEq)* with 3.05 m of 73.60 g/t gold and 1738.50 g/t silver or 95.33 g/t AuEq* in drill hole 21CCRC041 (Figure 1). The new drill results show significant expansion potential with continued strong mineralization along the margins of the 2021 modelled pit shell. The results are providing a vectoring tool to model and expand additional, robust high-grade mineralized systems to the south (Figure 2). The Cliff Creek North zone remains open showing strong continuity from surface to over 550 vertical metres depth with potential for open pit as well as underground mining. Benchmark’s flagship Lawyers Gold-Silver Project is located within a road-accessible region of the prolific Golden Horseshoe area of north-central British Columbia, Canada.

John Williamson, CEO, commented, “The Cliff Creek North area continues to provide more high-grade gold and silver material. The new results are filling gaps with tighter drill spacing that is demonstrating mineralization that will grow the forthcoming Mineral Resource Estimate. In addition, the high-grade, near surface mineralization is showing potential as an initial mining area (pit) that could significantly boost economics in the Preliminary Economic Assessment (PEA).”

Highlights

- Increasingly robust mineralization with high-grade mineralization within high-grade bulk tonnage zones in the upper southeast portion of Cliff Creek North, demonstrating effective targeting of the modelled high-grade mineralization trending to the south that includes 30.48 metres (m) of 8.96 g/t gold and 233.04 g/t silver or 11.87 g/t AuEq* with 15.24 m of 17.59 g/t gold and 454.33 g/t silver or 23.27 g/t AuEq* in drill hole 21CCRC041, and;

- At-depth testing of the southern portions of the 2021 $1600 modelled pit shell at Cliff Creek North intersected 38.33 m core length of 4.18 g/t gold and 117.32 g/t silver or 5.64 g/t AuEq with 4.00 m of 8.80 g/t gold and 433.75 g/t silver or 14.22 g/t AuEq* in drill hole 21CCDD023, and;

- Excellent continuity of infill and expansion drilling within the Cliff Creek North zone including 153.00 m of 1.24 g/t gold and 17.73 g/t silver or 1.46 g/t AuEq with 6.44 m of 2.51 g/t gold and 54.94 g/t silver or 3.19 g/t AuEq* in drill hole 21CCDD047.

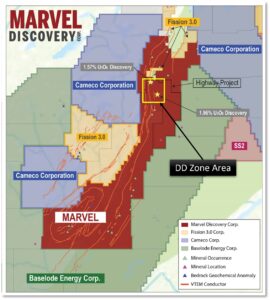

Figure 1: Plan map at the Cliff Creek Zone highlighting new 2021 drill results.

Figure 2: Long-section at the Cliff Creek Zone showing gold and silver results from a series of drill holes.

Table 1: Drill results summary from the Cliff Creek North Zone

| Drillhole | From (m) | To (m) | Interval (m)* | Au (g/t) | Ag (g/t) | AuEq (g/t) | |

| 21CCDD010 | 22.04 | 23.78 | 1.74 | 4.27 | 109.91 | 5.64 | |

| 88.00 | 118.00 | 30.00 | 1.28 | 60.01 | 2.04 | ||

| incl. | 103.34 | 110.00 | 6.66 | 3.09 | 206.88 | 5.68 | |

| incl. | 107.00 | 109.00 | 2.00 | 7.38 | 592.50 | 14.78 | |

| 140.00 | 149.96 | 9.96 | 0.29 | 14.64 | 0.48 | ||

| 175.00 | 177.00 | 2.00 | 1.08 | 47.50 | 1.67 | ||

| 21CCDD023 | 42.54 | 43.49 | 0.95 | 2.28 | 30.76 | 2.66 | |

| 247.00 | 248.40 | 1.40 | 1.81 | 33.74 | 2.23 | ||

| 260.00 | 281.00 | 21.00 | 0.54 | 21.16 | 0.80 | ||

| incl. | 267.00 | 274.00 | 7.00 | 1.15 | 54.15 | 1.82 | |

| incl. | 272.00 | 273.00 | 1.00 | 3.61 | 115.00 | 5.05 | |

| 290.67 | 329.00 | 38.33 | 4.18 | 117.32 | 5.64 | ||

| incl. | 290.67 | 291.17 | 0.50 | 6.00 | 115.00 | 7.44 | |

| and | 293.00 | 297.00 | 4.00 | 8.80 | 433.75 | 14.22 | |

| and | 317.00 | 319.00 | 2.00 | 40.45 | 725.00 | 49.51 | |

| and | 321.00 | 322.00 | 1.00 | 5.02 | 97.60 | 6.24 | |

| 21CCDD038 | 7.00 | 26.00 | 19.00 | 0.77 | 6.90 | 0.86 | |

| incl. | 15.00 | 16.00 | 1.00 | 9.59 | 41.70 | 10.11 | |

| 149.80 | 189.85 | 40.05 | 0.93 | 33.62 | 1.35 | ||

| incl. | 155.68 | 169.21 | 13.53 | 2.03 | 70.30 | 2.91 | |

| incl. | 168.40 | 169.21 | 0.81 | 9.18 | 299.00 | 12.92 | |

| 21CCDD047 | 43.00 | 61.00 | 18.00 | 0.82 | 42.70 | 1.35 | |

| incl. | 48.00 | 49.00 | 1.00 | 4.13 | 56.60 | 4.84 | |

| 187.00 | 340.00 | 153.00 | 1.24 | 17.73 | 1.46 | ||

| incl. | 213.56 | 220.00 | 6.44 | 2.51 | 54.94 | 3.19 | |

| or | 333.77 | 334.79 | 1.02 | 89.50 | 154.00 | 91.43 | |

| 21CCDD048 | 12.33 | 45.00 | 32.67 | 0.30 | 3.46 | 0.34 | |

| incl. | 12.33 | 13.31 | 0.98 | 2.83 | 40.40 | 3.34 | |

| 168.00 | 241.00 | 73.00 | 1.92 | 45.37 | 2.49 | ||

| incl. | 170.00 | 171.00 | 1.00 | 45.10 | 1250.00 | 60.73 | |

| and | 228.00 | 229.00 | 1.00 | 17.30 | 67.00 | 18.14 | |

| 21CCDD050 | 117.40 | 130.00 | 12.60 | 0.72 | 17.67 | 0.94 | |

| incl. | 117.40 | 118.27 | 0.87 | 1.67 | 188.00 | 4.02 | |

| 165.00 | 283.52 | 118.52 | 0.94 | 29.39 | 1.31 | ||

| incl. | 225.00 | 225.45 | 0.45 | 16.35 | 488.00 | 22.45 | |

| and | 280.00 | 282.08 | 2.08 | 8.13 | 326.76 | 12.22 | |

| 21CCRC041 | 12.19 | 51.82 | 39.62 | 1.17 | 43.60 | 1.71 | |

| incl. | 27.43 | 42.67 | 15.24 | 2.64 | 99.80 | 3.89 | |

| incl. | 38.10 | 39.62 | 1.52 | 15.10 | 643.00 | 23.14 | |

| 80.77 | 111.25 | 30.48 | 8.96 | 233.04 | 11.87 | ||

| incl. | 80.77 | 96.01 | 15.24 | 17.59 | 454.33 | 23.27 | |

| incl. | 89.92 | 92.96 | 3.05 | 73.60 | 1738.50 | 95.33 |

* Gold equivalent (AuEq) calculated using 80:1 silver to gold ratio.

** Intervals are core-length. True width is estimated between 80 to 90% of core length.

Quality Assurance and Control

Results from samples were analyzed at ALS Global Laboratories (Geochemistry Division) in Vancouver, Canada (an ISO/IEC 17025:2017 accredited facility). The sampling program was undertaken by Company personnel under the direction of Rob L’Heureux, P.Geol. A secure chain of custody is maintained in transporting and storing of all samples. Gold was assayed using a fire assay with atomic emission spectrometry and gravimetric finish when required (+10 g/t Au). Analysis by four acid digestion with 48 element ICP-MS analysis was conducted on all samples with silver and base metal over- limits being re-analyzed by atomic absorption or emission spectrometry. Rock chip samples from outcrop/bedrock are selective by nature and may not be representative of the mineralization hosted on the project.

The technical content of this news release has been reviewed and approved by Michael Dufresne, M.Sc, P.Geol., P.Geo., a qualified person as defined by National Instrument 43-101.

About Benchmark Metals

Benchmark Metals Inc. is a Canadian based gold and silver company advancing its 100% owned Lawyer’s Gold-Silver Project located in the prolific Golden Horseshoe of northern British Columbia, Canada. The Project consists of three mineralized deposits that remain open for expansion, in addition to +20 new target areas along the 20 kilometre trend. The Company trades on the TSX Venture Exchange in Canada, the OTCQX Best Market in the United States, and the Tradegate Exchange in Europe. Benchmark is managed by proven resource sector professionals, who have a track record of advancing exploration projects from grassroots scenarios through to production.

ON BEHALF OF THE BOARD OF DIRECTORS

s/ “John Williamson”

John Williamson, Chief Executive Officer

For further information, please contact:

Jim Greig

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

Telephone: +1 604 260 6977

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This news release may contain certain “forward looking statements”. Forward-looking statements involve known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Any forward-looking statement speaks only as of the date of this news release and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.