Uranium bulls are fired up lately, they think 2023 is the year that everything changes…. They thought the same thing in 2019-2020-2021! To be fair, COVID-19 and raging inflation slowed the uranium freight train, but there’s no stopping it.

Although the uranium price today at $51/lb. is nothing to write home about, it’s higher than it has been for much of the past seven years. The reason why this level can’t hold is that large new projects in places like Africa(low-grade deposits) require north of $80/lb. to get started. The world needs every pound it can get.

Most experts agree that the price will eventually surpass $75/lb., on its way to $100/lb. The only question is when. Many pundits think it could be this year. What has changed since last year or the year before?

The Russian war on Ukraine will have a huge impact on geopolitical affairs for years to come.

Russia, and especially former Soviet Republic Kazakhstan, have important stakes in the uranium fuel market that includes uranium, enrichment & refining. The world’s headed to a West vs. East mentality. China is increasingly viewed by the West as an adversary.

Kazakhstan produces more uranium than the next five countries combined

There’s an urgent need for the U.S. to source critical elements like uranium & lithium from “friendly” countries like Canada, Mexico, Australia. Canada is by far the most natural partner for the U.S. to turn to, especially for uranium.

As the world’s largest consumer wakes up to its vulnerable position (less than 5% of what the U.S. needs is produced domestically)China & India (home to 2.8B people, or 35% of the world’s population)are also in desperate need of long-term reliable uranium supply.

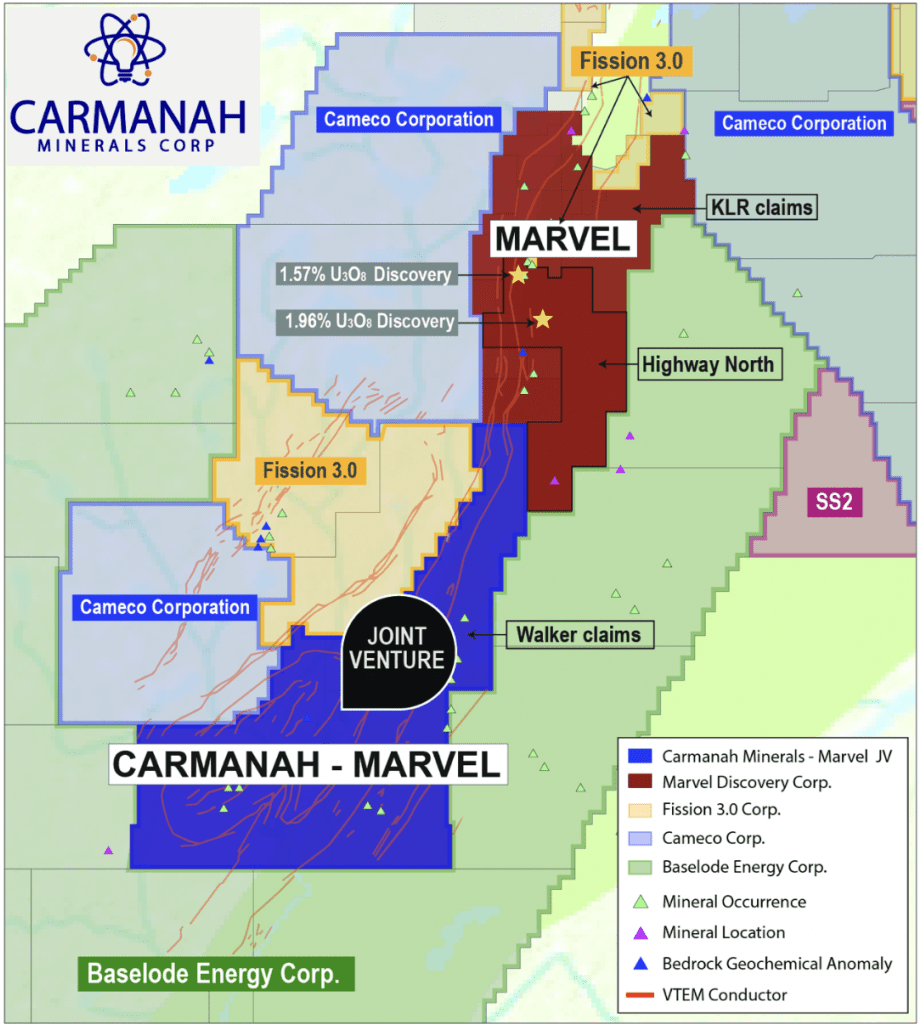

It appears increasingly likely that Canada will be the major supplier to the U.S., and Kazakhstan will supply China & India. Great news for Canada, as the U.S consumes > 50M pounds/yr., which is 5x as much as Canada produced in 2021! Last year Carmanah Minerals Corp. (CSE: CARM) signed a JV agreement with Marvel Discovery Corp. to earn a 50% interest in the Walker claims located in the Athabasca basin, Saskatchewan. Both companies are small and have tremendous blue-sky potential.

Carmanah Minerals partners with Marvel Discovery on Walker uranium claims

Upon completion of the earn-in, Marvel & Carmanah would each own 50% of the project with Carmanah financing $1.5M in exploration expenditures, paying $400k in cash and issuing 3.5M shares + 3.5M warrants over a three-year period.

“We are very excited to have reached an agreement with Marvel Discovery on this project; it is ideally situated along the Key Lake fault, host to some of the highest-grade uranium in the world. The project is directly tied on to Fission’s & Cameco’s ground, which runs along the Key Lake shear zone and hosts 10 uranium showings and multiple EM [electromagnetic] targets.

This corridor represents a tremendous opportunity in mimicking the success of basement-hosted uranium deposits found on the western side of the Athabasca basin like NexGen Energy’s Arrow deposit. Marvel has done a remarkable job advancing the project and we look forward to working with our new partner with the goal of a Tier 1 discovery,” stated Latika Prasad, CEO ofCarmanah.

The Walker properties lie within the Wollaston-Mudjactic transition zone of the eastern Athabasca basin, which is host to the highest-grade uranium mines in the world, including:

- Cigar Lake, 50% owned by Cameco, hosts reserves of 221.6M pounds of U at 16.7% U;

- Wheeler Project, 90% owned by Denison Mines, which hosts reserves of 109 million lb. of U in two deposits averaging 11.23% U.

- McArthur River, 70% owned by Cameco, which hosts reserves of 392 million lb. of U at 6.91% U;

In the map above, one can see that the Walker property borders Fission 3.0, (now called F3 Uranium) which has outperformed most uranium juniors and now has a market cap of $116M. Compare that to under $2M for Carmanah. Notice that Marvel has a few 1% uranium hits north of the Walker claims.

If F3 continues to make discoveries next to Carmanah’s & Marvel’s Walker property, that can only be good for Carmanah. There’s speculation that Cameco, who also borders the Walker claims, could take out F3. Notice on the map that Cameco surrounds F3.

Baselode Energy (in green) also holds a large land position in the area. It has a $44M market cap. In a uranium bull market where the price spikes well above the current level of $51/lb., there would be increased M&A.

Clearly, any combination involving Cameco, F3, Baselode, Carmanahor Marvel Exploration would be great news for tiny Carmanah and (larger but still small) Marvel Exploration.

Even without M&A in the near-term, drill results around Carmanah will be important drivers of excitement in the region. If one is bullish on uranium, Carmanah offers a lot of uranium bang for the buck!

Carmanah earning into 100% interest in the Loljuh property in the Golden Triangle

Carmanah is more than an exciting uranium story, it also has an option to earn into 100% of the 1,658 ha Loljuh property in B.C. Canada’s Golden Triangle.

In image below, vein sample, 5.0% Cu, 1.2% Au + 31 g/t Ag.

This area is world-famous for high-grade gold deposits, but also copper & silver. This is an early-stage property, there’s been no drilling on it.

However, there have been samples taken with some promising grades (see images). There are also showings of lead, zinc & molybdenum.

Carmanah Minerals (CSE: CARM) offers investors a low-cost entry into the #uranium sector + a shot in the Golden Triangle. Either properties could be company-makers.

The Company is surrounded by actively exploring/developing uranium players in the Athabasca basin.

shear zone at Pete Showing (2019) Sampled 4.3% Cu, 49 g/t Ag, 1.12 g/t Au + 27 ppm Mo

Good news by nearby neighbors or eventual drilling by Marvel or Carmanah on their JV Walker Claims could be a major catalyst for a company with a market cap under $2M. High risk, but high return potential as well.

Disclosures: Peter Epstein & Epstein Research [ER] have no prior or existing relationship with Carmanah Minerals or its team.