2021-10-05 13:31:02

Popular crypto trader and analyst Scott Melker is predicting new rallies for Polygon and two other altcoins while saying that Tezos is cleared for take-off.

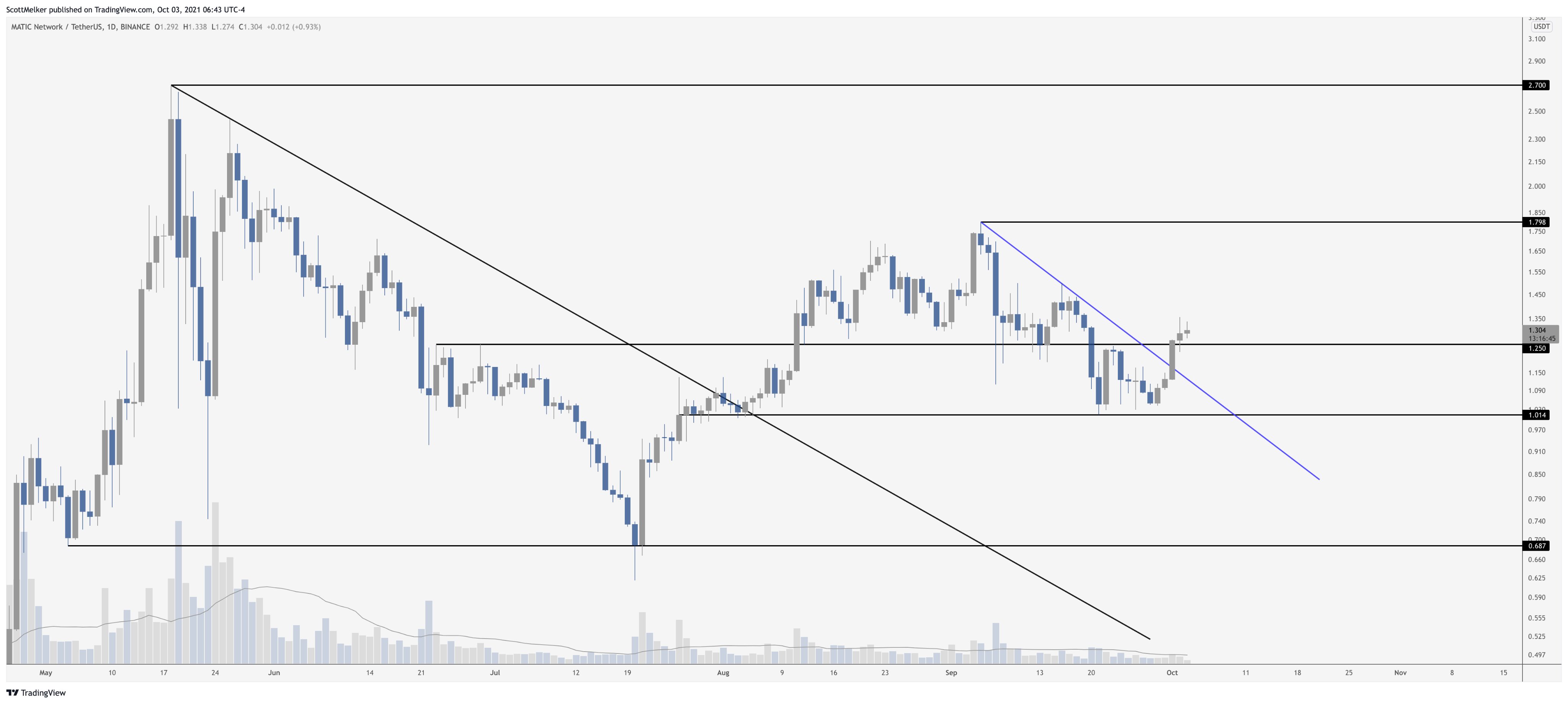

Melker tells his 595,300 Twitter followers that Ethereum scaling solution Polygon (MATIC) is primed to move higher after taking out its diagonal resistance that has kept the altcoin in a downtrend last month.

“MATIC target $1.79. Then higher.”

From MATIC’s current value of $1.28, Melker’s initial target represents an upside potential of nearly 40%.

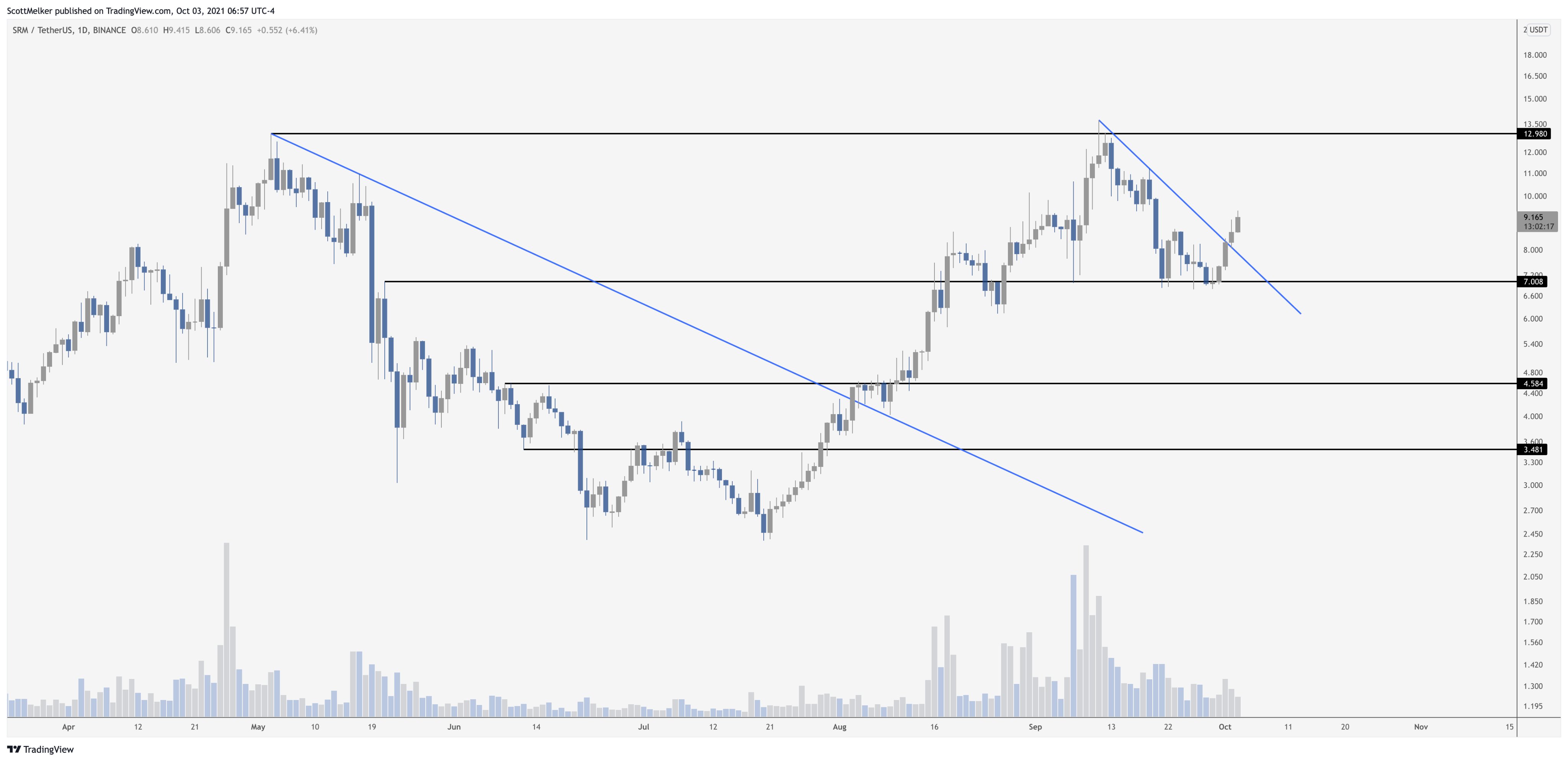

Another coin on the trader’s list is decentralized derivatives exchange Serum (SRM). According to Melker, SRM is following the footsteps of MATIC and appears poised for potential gains of over 50%.

“SRM target ~$13.”

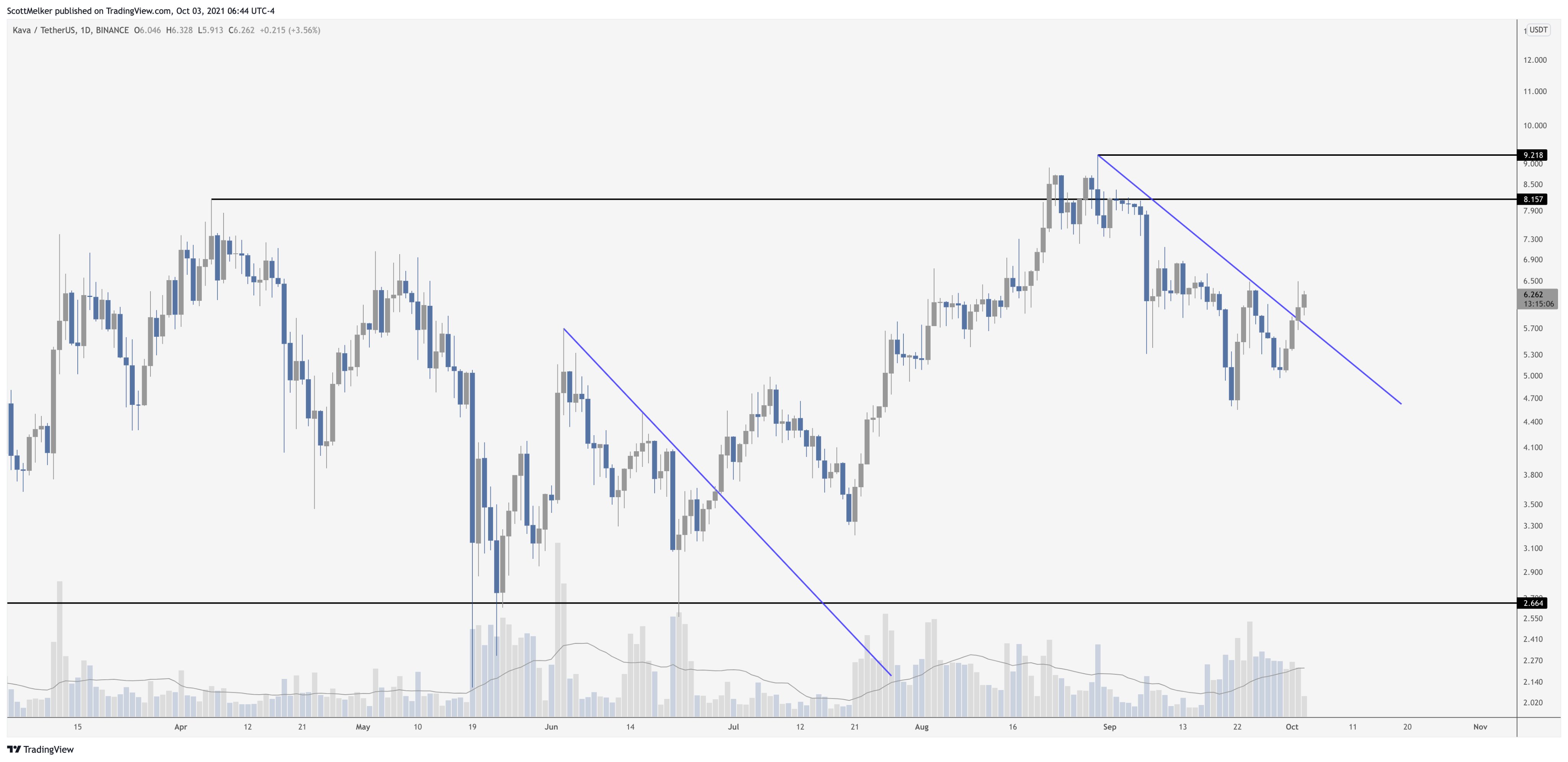

Next up is decentralized cross-chain money market Kava.io (KAVA), which Melker says has also ended its market slump and is gearing up for a 46% surge from its current price of $6.28.

“KAVA Target $9.20.”

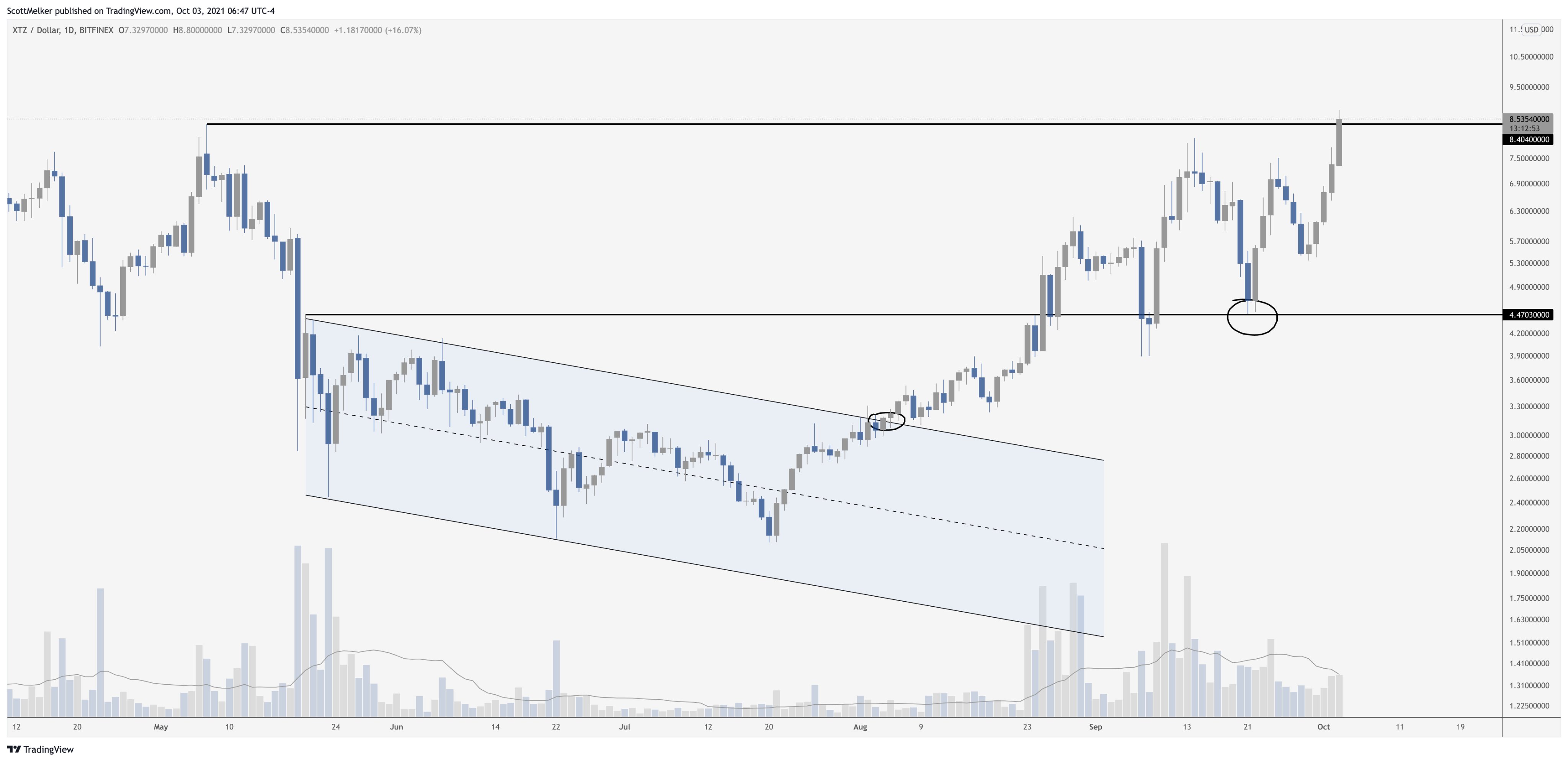

Looking at smart contract platform Tezos (XTZ), the crypto analyst believes that the altcoin is one resistance away from printing a new all-time high and heading into uncharted territory.

“Already almost 3x from first entry and a 2X from second entry (black circles). Flirting with price discovery, currently just the tip. Close above $8.4 and sky is the limit.”

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/NextMarsMedia