2023-08-01 17:18:39

HIGHLIGHTS

-

Golden Horse has entered into agreements to acquire the Ennuin Package, including:

-

The Birthday Mine project, Ennuin exploration tenement, Newfield East prospect and associated infrastructure

-

Strategic prospecting lease over historic 1.5m ounce Copperhead gold mine

-

Remaining 10% equity of E77/2691

-

P77/4593 (South of Battler Gold Mine) and E77/2829.

-

-

Mining of Pilot stockpile complete, delivering 1,578 ounces of gold and A$4.5m in revenue

Perth, Australia–(Newsfile Corp. – August 1, 2023) – Golden Horse Minerals Limited (TSXV: GHML) (“Golden Horse” or the “Company”) is pleased to announce the Company has further bolstered its landholding in the Southern Cross Greenstone Belt having entered into agreements dated 26 July 2023 and 1 August 2023 to acquire further tenements located within the Yilgarn Mineral Field, Western Australia.

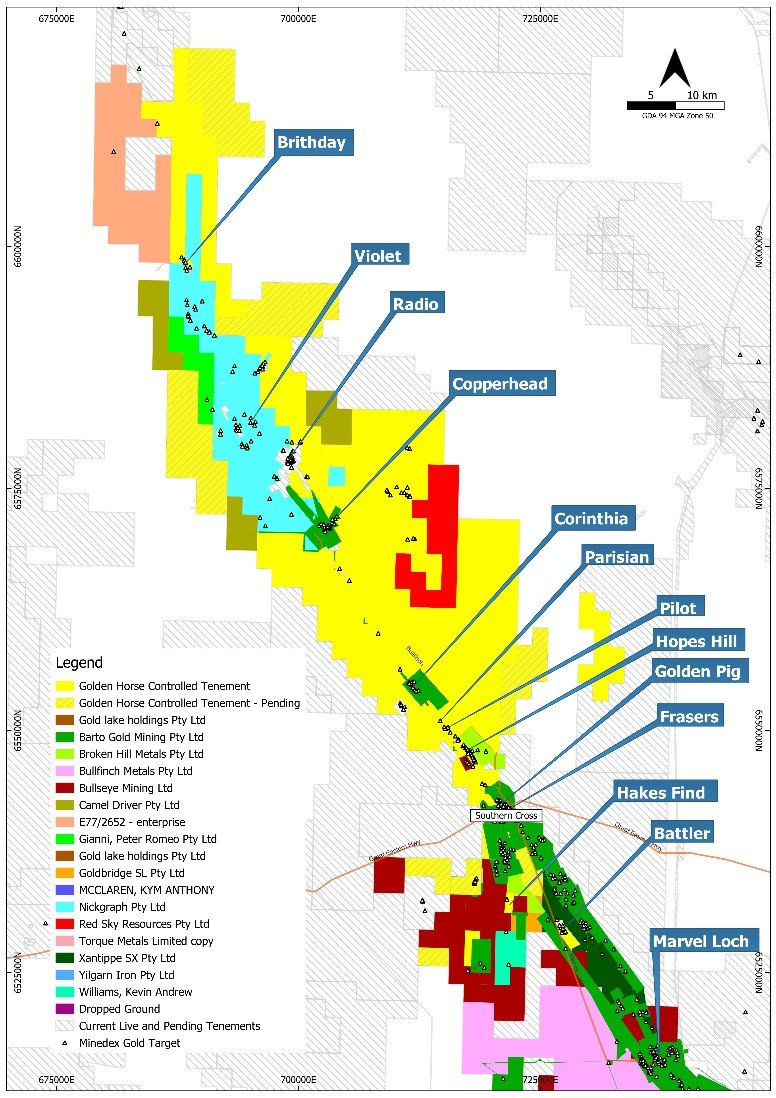

The Southern Cross Greenstone Belt is one of Australia’s top producing gold provinces having produced more than 12Moz of gold and the Company has now successfully consolidated more than 930km2 of tenure within the northern extent of the region (see Figure 1).

Figure 1: 933km2 tenure under Golden Horse Mineral Limited control (Yellow)

Figure 1: 933km2 tenure under Golden Horse Mineral Limited control (Yellow)

Ennuin Package

Golden Horse has entered into an agreement with prospectors Vernon Strange and Kym McClaren to acquire a series of projects (the “Ennuin Package”) which are located approximately 30km north of the town of Bullfinch.

The Ennuin Package consists of:

-

– Birthday Mine project (M77/450, L77/262 & G77/123);

-

– Ennuin Exploration Tenement (E77/2429);

-

– Newfield East project (P77/4629, P77/4630 and P77/4631);

-

– Strategic Copperhead Prospecting Lease (P77/4357);

-

– Remaining 10% equity of E77/2691; and

-

– Tenure south of Battler Gold Mine (P77/4593) and Blackbourne (E77/2829)

Birthday Mine Project

Figure 2: Birthday Mine Portal

Figure 2: Birthday Mine Portal

The Birthday tenement cover 0.6km2 and is located 30km north of Bullfinch. The tenement encompasses a series of historic underground gold mining operations at Birthday, Birthday Extended, Birthday South, Birthday West, and Birthday West Extended.

Production at the Birthday mine commenced in 1911 and operations occurred intermittently over the following 40 years. The most recent underground operations occurred between 2000-2010. Despite an active history, Golden Horse believes the site continues to remain highly prospective for further gold mineralisation. Operations at Birthday and Birthday South, which are approximately 550m apart are interpreted as mining a mineralised, shear-hosted quartz reef which remains open to the north, south and at depth.

Ennuin Exploration Tenement

E77/2429 is an exploration tenement covering 91km2 located approximately 32 kilometres north of Bullfinch. The site is approximately 5km east of the Mt Jackson Road and is accessible by graded gravel roads.

A significant portion of E77/2429 covers the northern end of Southern Cross Greenstone belt and is interpreted to contain gold, base metals and iron mineralisation.

A due diligence field trip has identified a number of prospects including Birthday North that the Golden Horse Minerals team will be following up with desktop work.

Newfield East project

The Newfield East Project contains 3 prospecting licences (P77/4629, P77/4630 & P77/4631) covering 4.8km2, located 55km North of bullfinch.

The Newfield East Project offers a prospect to the north of the group of prospecting leases that was last drilled by Bullseye Mining Limited in 2012 targeting Copper and Gold (WAMEX report).

Strategic Copperhead Prospecting Lease (P77/4357)

Golden Horse has acquired a strategic prospecting lease for an area located immediately adjacent to the Copperhead mine, near the town of Bullfinch.

The lease is highly prospective for gold mineralisation given its location, with the Copperhead mine estimated to have produced approximately 1.5 Moz Au.

Figure 3: P77/4357 located at the Copperhead Mine

Figure 3: P77/4357 located at the Copperhead Mine

Remaining 10% equity of E77/2691

Golden Horse Minerals now wholly owns tenement E77/2691 after purchasing the outstanding 10% equity in the tenement. E77/2691 is a large exploration license covering 116km2 and is located between Southern Cross and Bullfinch in Western Australia. The ground is highly prospective for gold, nickel, and other commodities.

E77/2691 is located between known nickel sulphide locations (Forrestania nickel deposits to the south and Trough Well to the north). See Figure 4 below and the Company’s announcement dated 23 February 2023 for further information.

Figure 4: E77/2691 tenement area in the Southern Cross region

Figure 4: E77/2691 tenement area in the Southern Cross region

P77/4593 and E77/2829 Acquisition

The Company has entered into agreements to acquire P77/4593 and E77/2829, located south of Southern Cross township.

P77/4593 covers 1.9km2 and lies approximately 15 kilometres south-southeast of the Southern Cross township, immediately to the south of the privately-owned IMD Gold Mines’ Battler Gold Mine. P77/4593 is located next to infrastructure and approximately 20 kilometres from the Marvel Loch Mill.

E77/2829 covers 2.5km2 and lies approximately 5kms southwest from the town of Southern Cross. Previous exploration work at the tenement consisting of soil sampling and has identified an untested anomaly.

Production Update

Golden Horse has previously announced the commencement of mining, processing stockpile material from the historical Pilot Gold Mine at the Marvel Lock Mill (see the Company’s announcement dated 19 June 2023). The Company is pleased to report the completion of these activities and provides the following production update.

Approximately 35,600 tonnes of stockpile material was processed with the ore returning a head grade of 1.63g/t Au – slightly outperforming historical operations which typically returned grades around 1.5g/t Au. Processing occurred as expected under standard operating procedures, demonstrating the quality and consistency of mineralisation within the Southern Cross Greenstone Belt (see Figure 5).

Processing of the Pilot stockpile has delivered total revenues of approximately A$4.5m. These funds strengthen Golden Horse’s balance sheet, facilitating further consolidation activity within the Fraser Shear Zone and also emphasise the Company’s ability to execute its plans and monetise assets.

Figure 5: First gold poured from processing of the mineralised stockpile at Pilot

Figure 5: First gold poured from processing of the mineralised stockpile at Pilot

Golden Horse Minerals Chairman and Interim CEO, Graeme Sloan, said: “I am thrilled to report a whole host of acquisition activities as the Company further consolidates tenure all along the Fraser Shear. These acquisitions place Golden Horse in the box seat with the largest tenement holdings along the Southern Cross Greenstone Belt. This is a tier-1 jurisdiction with significant opportunities to define economic quantities of gold.

“In addition, I am also pleased to announce the revenue windfall from stockpile material at Pilot. The processing of this material is critically important for a number of reasons. Firstly, this demonstrates Golden Horse management will follow through, executing activities which they say they will do.

“But also, these funds place your company in an even stronger position to deploy capital. With an enlarged balance sheet Golden Horse has the opportunity to further expand our landholding in the Southern Cross region and return significant value for shareholders through discovery.

“I look forward to keeping shareholders informed of our progress as we move deeper into the second half of CY2023.”

Transaction

Golden Horse will pay in total A$90,000 cash to the vendors for the two tenements P77/4593 & E77/2829.

The purchase of remaining 10% equity in E77/2691 will consist of A$300,000 worth of fully paid common shares in Golden Horse. The transaction details have also been revised with a 0.5% increase in the gross smelter royalty to 2% gross smelter royalty on all metals and minerals extracted from the tenement.

The Ennuin Package including tenements E77/2429, M77/450, L77/262, G77/123, P77/4629, P77/4630 & P77/4631, Golden Horse will pay A$100,000 cash and issue A$175,000 worth of fully paid common shares in Golden Horse upon execution and subsequently pay A$150,000 cash upon the lesser of dual listing or within 6 months of execution plus a 1.5% Gross Smelter Royalty capped at A$800,000. Golden Horse has the election to extend 6 months with the payment of a A$50,000 extension fee.

The strategic Copperhead prospecting tenement, P77/4357 Golden Horse will pay A$50,000 cash on execution and issue A$250,000 worth of common paid ordinary shares in Golden Horse and subsequently pay A$200,000 cash upon the lesser of dual listing or within 6 months of execution plus a 1.5% Gross Smelter Royalty capped at A$800,000. Golden Horse has the election to extend 6 months with the payment of a A$50,000 extension fee.

The foregoing acquisitions and related issuance of common shares of the Company to the vendors remain subject to the approval of the TSX Venture Exchange.

On behalf of Golden Horse Minerals Limited

For more information contact:

Graeme Sloan

Director / Interim CEO

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

+61 9322 1788

Josh Conner

Chief Operating Officer

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

+61 9322 1788

Media

David Tasker

Chapter One Advisors

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

+61 433 112 936

Cautionary Statement on Forward-Looking Information

This release may contain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties, and other factors which may cause the actual results, performance, or achievements of Golden Horse to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements. These forward-looking statements are based on management’s current expectations and beliefs but given the uncertainties, assumptions and risks, readers are cautioned not to place undue reliance on such forward-looking statements or information. Actual results may differ materially from those currently anticipated in such statements, and Golden Horse undertakes no obligation to update such statements, except as required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Qualified Person

Mr. Neal Leggo, a member of the Australian Institute of Geoscientists (MAIG) and an independent Qualified Person as defined by National Instrument 43-101, is responsible for the preparation of the technical content regarding the Southern Cross North Project contained in this document. Mr. Leggo is a Principal Geological Consultant with Indeport Pty Ltd. Mr Leggo has reviewed and approved the technical disclosure in this news release.