2021-11-09 07:01:19

VAL-D’OR, Québec, Nov. 09, 2021 (GLOBE NEWSWIRE) — Corporation Ressources Pershimex (“Pershimex” or the “Society”) (TSX CROISSANCE : PRO) is pleased to announce the results of the Mineral Resource Estimation (“MRE”) undertaken in early 2021 by the firm 3DGeo Solution inc. (“3DGS”) under the supervision of Mr. Kenneth Williamson, P.Geo, M.Sc., Senior Consultant Geologist and President. The portion of the pit optimization work was entrusted to the engineering firm BBA Inc., under the supervision of Mr. Jeff Cassoff, P. Eng., Senior Mining Engineer and Team Leader.

This ERM is based on the integration of all the assay results from the holes drilled in 2020 and from the holes drilled in spring of 2021, as well as from the channel sampling work completed on August 10, 2021. The ERM includes all the assay results received as of September 7, 2021. Thus, 2,169 meters of drilling and 2,788 samples will have been necessary to define a near surface gold resource, representing a total investment of less than $ 1 million.

The initial objective set by the management of the company was to bring the historical mineral inventory contained in the surface crown pillar of the former Pershing-Manitou mine into compliance with respect to the actual regulations. By carrying out this ERM, the Company is now able to define a volume of high grade gold material not exceeding 5000 tonnes in order to comply with the standards set by the government with regard to permit applications for conducting a bulk sampling program. Such bulk sampling will validate the approach to taken in order to maximize further development work on the Pershing-Manitou deposit. With the current market conditions, the Company hopes to generate an attractive profit by mining this high gold grade material.

Results of the Mineral Resource Estimate of the surface crown pillar of the Pershing-Manitou Mine

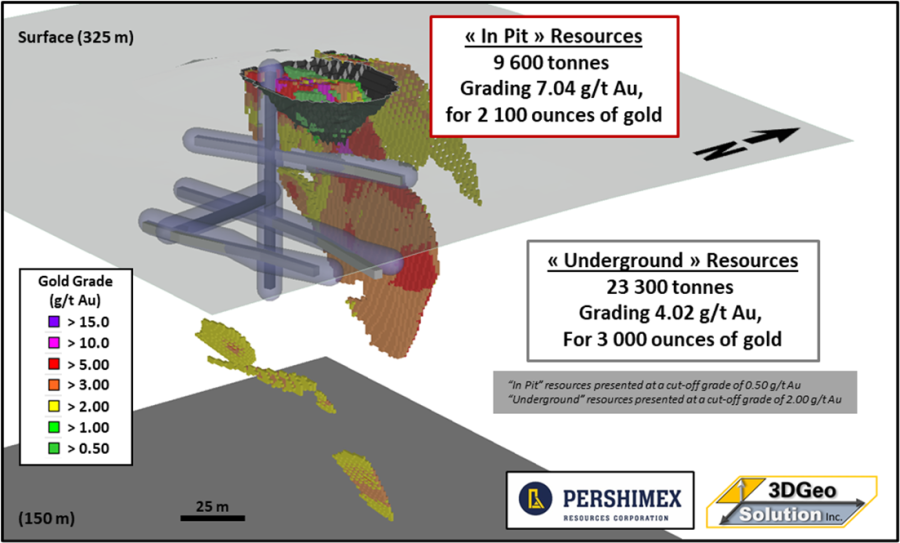

- Definition of an “in-pit” resource of 9,600 tonnes grading 7.04 g / t Au, representing nearly 2,100 ounces of gold, the vast majority of which is classified as measured category.

- Underground potential of nearly 23,300 tonnes at a grade of 4.02 g / t Au, representing just over 3,000 ounces of gold, mainly of the indicated category.

- Table 1 presents an isometric view of the “in-pit” and “underground” gold resource

Table 1: Estimate of “in-pit” mineral resources for the Pershing-Manitou Project using a cut-off grade of 0.50 g / t Au; sensitivity presented at different cut-off grades.

| MEASURED RESOURCES | INDICATED RESOURCES | INFERRED RESOURCES | |||||||||

| Cut-off grade (g/t Au) | Tonnes (t) | Grade (g/t Au) | Ounces (oz) | Tonnes (t) | Grade (g/t Au) | Ounces (oz) | Tonnes

(t) |

Grade

(g/t Au) |

Ounces

(oz) |

||

| ALL ZONES | > 0.80 | 8,600 | 7.66 | 2,120 | 400 | 3.50 | 40 | – | – | – | |

| > 0.70 | 8,800 | 7.52 | 2,100 | 400 | 3.50 | 40 | – | 0.72 | – | ||

| > 0.60 | 8,900 | 7.41 | 2,100 | 400 | 3.47 | 40 | 300 | 0.66 | 10 | ||

| > 0.50 | 9,200 | 7.20 | 2,100 | 400 | 3.46 | 40 | 500 | 0.60 | 10 | ||

| > 0.40 | 9,500 | 7.00 | 2,100 | 400 | 3.45 | 40 | 1,100 | 0.53 | 20 | ||

| > 0.30 | 9,800 | 6.80 | 2,100 | 600 | 2.22 | 40 | 1,300 | 0.50 | 20 | ||

| > 0.20 | 10,000 | 6.66 | 2,100 | 1,100 | 1.34 | 50 | 1,300 | 0.49 | 20 | ||

(SEE THE NOTES RELATED TO THE OF PERSHING-MANITOU MINERAL RESOURCES ESTIMATE BELOW)

Table 2: Estimate of the “underground” mineral resources of the Pershing-Manitou Project using a cut-off grade of 2.00 g / t Au; sensitivity presented at different cut-off grades.

| MEASURED RESOURCES | INDICATED RESOURCES | INFERRED RESOURCES | |||||||||

| Cut-off grade (g/t Au) | Tonnes (t) | Grade (g/t Au) | Ounces (oz) | Tonnes (t) | Grade (g/t Au) | Ounces (oz) | Tonnes(t) | Grade (g/t Au) |

Ounces

(oz) |

||

| ALL ZONES | > 5.00 | 1,200 | 7.60 | 290 | 4,000 | 6.06 | 780 | – | 5.68 | – | |

| > 3.00 | 2,300 | 5.76 | 430 | 13,200 | 4.66 | 1,980 | 1,300 | 3.49 | 150 | ||

| > 2.50 | 3,200 | 4.97 | 510 | 15,100 | 4.41 | 2,140 | 2,200 | 3.20 | 230 | ||

| > 2.00 | 4,200 | 4.29 | 580 | 19,100 | 3.96 | 2,430 | 3,000 | 2.95 | 280 | ||

| > 1.50 | 6,000 | 3.53 | 680 | 30,700 | 3.11 | 3,070 | 14,800 | 1.93 | 920 | ||

| > 1.00 | 7,900 | 2.98 | 760 | 61,100 | 2.17 | 4,260 | 79,400 | 1.36 | 3,470 | ||

| > 0.80 | 8,400 | 2.84 | 770 | 80,500 | 1.86 | 4,820 | 113,700 | 1.22 | 4,450 | ||

(SEE THE NOTES RELATED TO THE OF PERSHING-MANITOU MINERAL RESOURCES ESTIMATE BELOW)

This MRE is the result of 28 holes (3,955 meters of core drilling in total; 2,169 meters used for the construction of the resource model) and 3 channels (18 meters sampled) in the resource sector, with the all assay results received as of September 7, 2021. The drill spacing is approximately 10 to 15 meters for the drilling carried out in the core of the pillar close to the surface and 20 to 30 meters for the drilling targeting the intermediate part of the pillar. Below 75 m depth, the drill spacing is approximately 50 to 65 meters. Channel sampling was carried out on the central portion of the pillar, where the main mineralized zone outcrops.

The litho-structural interpretation of the deposit is based on the integration of drilling and surface mapping data. Litho-structural and preliminary interpretation of mineralized zones were performed using Seequent Leapfrog Geo ™ software, and then integrated into Geovia GEMS ™ software. The deposit is interpreted as a classical system of extension veins and shear veins developed within a deformation corridor. The best gold grades appear to be associated with extension veins, which appear as a series of sigmoidal veins distributed in echelon in mineralized envelopes that are slightly oblique to the shear veins. The presence of a late fault appears to be a limiting factor towards the east; the latter was used as a constraint in the construction of mineralized volumes. The mineral resource estimate encompasses 12 tabular domains, trending northeast in the north and central portions of the deposit, while trending east-west in the south. These volumes were built in Geovia GEMS ™ software using a set of contour lines on sections spaced 5 meters apart and tie lines. A real thickness of at least 2.00 meters is imposed on these volumes.

The MRE considers a total of 12 mineralized zones defined by individual wireframe models with a true thickness of at least 2.00 meters. The MRE includes blocks located inside a pit shell, and is reported at a cut-off grade of 0.50 g / t Au. The pit shell used is that constrained by a gold price of US $ 500.00 / oz; the purpose of this choice is to limit the size of the pit, therefore forcing the pit optimization to focus on the higher grade material near the surface. This will allow isolating and maximizing the volume of rocks chosen for the bulk sampling permit application. The MRE also includes mineralized blocks located outside the pit shell, but within volumes potentially exploitable by underground method, and is reported at a cut-off grade of 2.00 g / t Au.

Table 3: Parameters used to estimate the “in-pit” and underground cut-off grades for the purpose of estimating the mineral resources of the surface pillar of the Pershing-Manitou mine

| Paramètre | Unité | Valeur |

| Gold price | $ US/oz | 500,00 |

| Exchange rate | $ US/$ CA | 1,25 |

| Mill Recovery | % | 92 |

| Selling Costs | $ US/oz | 5,00 |

| Mining Cost – Overburden | $ CA/t milled | 3,00 |

| Mining Cost -Pit Rock | $ CA/t milled | 3,50 |

| Mining Costs – Underground | $ CA/t milled | 100,00 |

| General & Administration | $ CA/t milled | 4,00 |

| Processing Cost | $ CA/t milled | 22,00 |

| Transportation Costs | $ CA/t milled | 8,00 |

| Pit Slope – overburden / rock | deg | 26,6 / 50,0 |

| Cut-off grade – « in-pit » | g/t Au | 0,50 |

| Cut-off – underground | g/t Au | 2,00 |

President statement

Robert Gagnon, President and Chief Executive Officer of the Company, declares: “This work of estimating mineral resources made it possible to define, in a short time, a sufficient quantity of mineralized material potentially exploitable by surface mining. Some of this material is located on the surface and has the highest gold grades. This will allow the company to apply for an authorization from the Quebec Ministry of Natural Resources to extract a bulk sample of less than 5,000 tonnes. The production of this bulk would make it possible to extract a certain quantity of gold, which at the current market price, would provide the Company with attractive working capital. In the current context of a share price deemed too low, management has decided to capitalize on the measured resource and take advantage of it, thus preventing the company and its shareholders from being further diluted at a low price via traditional financing offered to junior exploration companies. “

The full technical report, prepared in accordance with the provisions of NI 43-101, will be available on SEDAR (www.sedar.com) under the Company’s issuer profile within 45 days.

NOTES RELATED TO THE OF PERSHING-MANITOU MINERAL RESOURCES ESTIMATE:

| 1. The Independent Qualified Person for the purposes of this SMR, as defined in NI 43-101, is Kenneth Williamson, P.Geo. (OGQ # 1490), of Solution 3DGéo inc. The effective date of the estimate is September 7, 2021.

2. The estimate of the mineral resources of the Pershing-Manitou project complies with the “CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines” of November 29, 2019. 3. These mineral resources are not mineral reserves since their economic viability has not been demonstrated. The quantity and grade of Inferred Mineral Resources presented in this news release are uncertain in nature and there has not been sufficient exploration work performed to define these resources as Indicated or Measured Resources; however, it is reasonable to expect that the majority of Inferred Mineral Resources can be converted to Indicated Mineral Resources by continuing exploration. 4. The resources are presented before dilution and in situ and are considered to have reasonable prospects of economic extraction. Isolated and discontinuous blocks with a grade greater than the selected cut-off grade are excluded from the estimate of underground mineral resources. The blocks that must be included, i.e. isolated blocks with a grade below the cut-off grade located within potentially mineable volumes, have been included in the mineral resource estimate. 5. As of September 7, 2021, the database included a total of 28 holes totaling nearly 3,955 meters of drilling and 3 channels totaling 18 meters sampled at surface in the targeted area for the estimation of mineral resources. 6. A value of 0.001 g / t Au was used as a grade for the un-assayed core, while a clipping grade of 31.1035 g / t Au was applied to composites with a higher gold grade. 7. The assays were grouped within the mineralized domains in composites of 1.00 meters in length. 8. The block model was prepared using Geovia GEMS ™ software. The model is of the “percentage and multi-layer” type and consists of cubic blocks of 1 meter side. The model has no rotation. 9. An interpolation according to the “inverse distance squared” (“ID2”) method was performed to estimate the gold grades in each of the interpreted mineralized volumes. The parameters for estimating gold grades are mainly based on the layout and the small amount of drilling available. Thus, the range of the different search ellipses is based on the spacing of the holes, while their orientation corresponds to the average orientation of the different mineralized zones. 10. Une valeur de densité de 2,70 g/cm3 a été appliquée aux zones minéralisées, 2,00 g/cm3 au mort-terrain et 2,80 g/cm3 à la roche encaissante. 11. The so-called “IN PIT” mineral resources are presented at a cut-off grade of 0.50 g / t Au and are confined within a pit shell. The cut-off grade estimate and the creation of the pit shell are based on the following economic parameters: gold price of US $ 500 / oz, exchange rate of USD / CAD 1.25, recovery at l 92% machining, selling cost US $ 5 / oz, mining cost CA $ 28.50 / t machined, G&A cost CA $ 4 / t machined, transportation cost CA $ 8 / t . 12. The underground mineral resources are presented at a cut-off grade of 2.00 g / t Au and correspond to the piles of contiguous blocks with a reasonable size to be exploited by the long-hole method. The economic parameters used are the same as for “IN PIT” mineral resources with the exception of the cost related to mining, set at CA $ 100 / t. It should be noted that the G&A cost could be underestimated depending on the extraction sequence chosen. 13. Calculations were performed with metric units (meters, tonnes and g / t). Metals content is presented in troy ounces (metric ton x grade / 31.10348). 14. The independent qualified person is not aware of any environmental, licensing, legal, title-related, tax, socio-political or marketing-related issue, or any other relevant issue that could have a material impact on the estimate of mineral resources. 15. The numbers of tonnes and ounces are rounded to the nearest hundred and ten respectively, which may cause slight differences. |

Qualified Person

The mineral resource estimate for the surface pillar at the Pershing-Manitou mine, with an effective date of September 7, 2021, was prepared by Kenneth Williamson, P.Geo. (OGQ no 1490), M. Sc., President and senior consultant geologist of Solution 3DGéo inc, a “qualified person” within the meaning assigned to this term in Regulation 43-101. Mr. Williamson is an employee of Solution 3DGéo inc. and is considered “independent” from Pershimex for the purposes of section 1.5 of NI 43-101.

The scientific and technical content of this press release has been reviewed and approved by Mr. Robert Gagnon, P.Geo., President of Pershimex, who is a “qualified person” under National Instrument 43-101.

For more information, please contact :

| Robert Gagnon, President Tél.: (819) 825-2303 |

Jacques Brunelle, VP Corporate Dev. Tél. : (819) 856-1387 |

Warning

The TSX Venture Exchange and its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) assumes no responsibility for the adequacy or accuracy of the information contained in this press release. Press.

Facts stated in this press release that are not historical facts are “forward-looking statements” and readers are cautioned that these statements are not a guarantee of success and that future developments and results may. be different from those projected in these forward-looking statements.