2021-11-22 04:19:29

We think that it’s fair to say that the possibility of finding fantastic multi-year winners is what motivates many investors. You won’t get it right every time, but when you do, the returns can be truly splendid. Take, for example, the Santacruz Silver Mining Ltd. (CVE:SCZ) share price, which skyrocketed 311% over three years. In the last week the share price is up 23%.

On the back of a solid 7-day performance, let’s check what role the company’s fundamentals have played in driving long term shareholder returns.

Check out our latest analysis for Santacruz Silver Mining

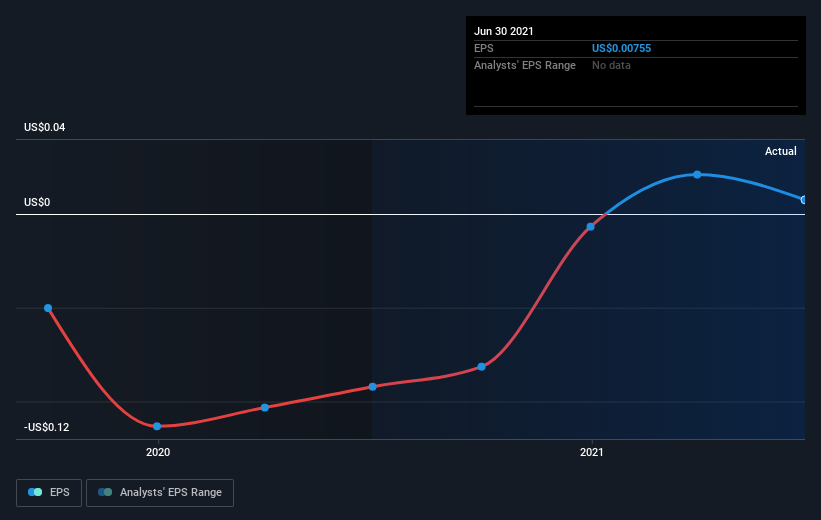

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During three years of share price growth, Santacruz Silver Mining moved from a loss to profitability. Given the importance of this milestone, it’s not overly surprising that the share price has increased strongly.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into Santacruz Silver Mining’s key metrics by checking this interactive graph of Santacruz Silver Mining’s earnings, revenue and cash flow.

A Different Perspective

Santacruz Silver Mining provided a TSR of 30% over the year. That’s fairly close to the broader market return. That gain looks pretty satisfying, and it is even better than the five-year TSR of 4% per year. It is possible that management foresight will bring growth well into the future, even if the share price slows down. It’s always interesting to track share price performance over the longer term. But to understand Santacruz Silver Mining better, we need to consider many other factors. For instance, we’ve identified 5 warning signs for Santacruz Silver Mining (1 is a bit concerning) that you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.