The price hike of everything means stagflation and the risk of recessions on Monday. Gas prices in Europe continued to rise after doubling last week and wheat is near a record after Ukraine’s departure as one of the world’s top grain suppliers. Copper, palladium and other metals also continue to rise. With the world yet to fully escape the coronavirus, with supply chains fraying again, rising commodity costs increasingly threatening businesses and consumers with a 1970s-style double whammy of even faster inflation and weaker demand.

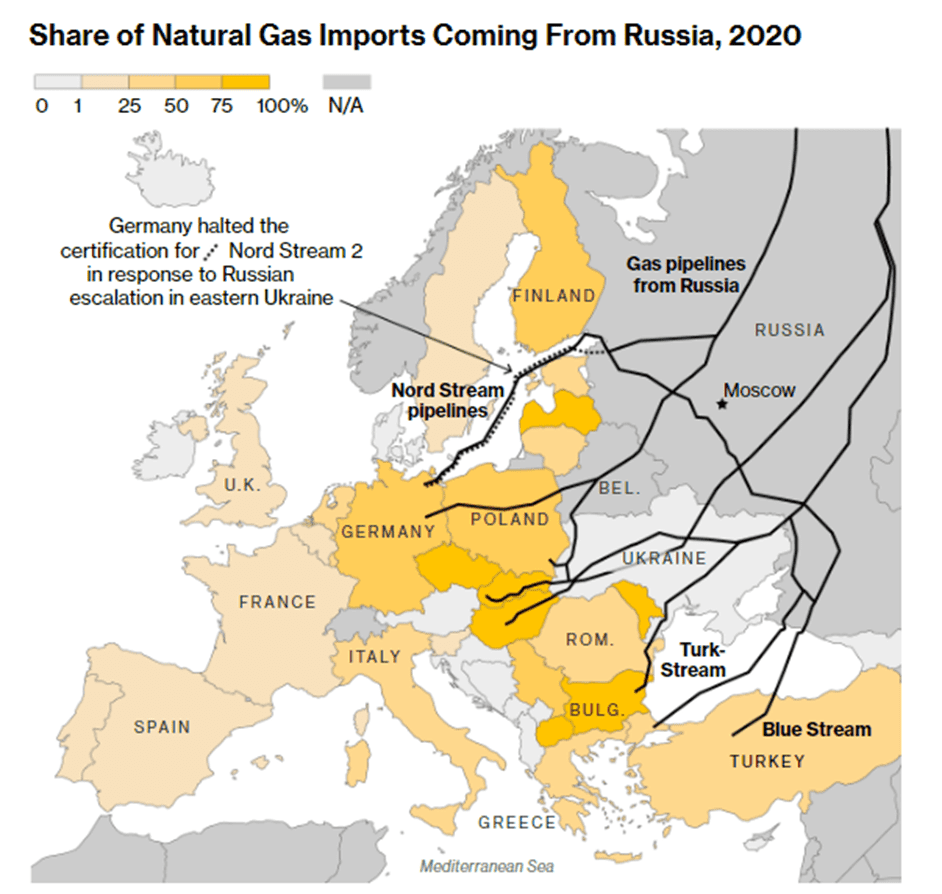

Note: Data for 2020 are not available for the U.K. and Bosnia-Herzegovina, 2019 data are shown in those countries. Norway imported 10 million cubic meters of gas from Russia in 2020, but as a net exporter is not dependent on Russian imports

In query is whether or not economies will go through stagflation or some other recession simply years because the pandemic compelled the private droop in decades. Europe, which makes use of Russia for approximately 40% of its fueloline needs, is at precise risk, despite the fact that the U.S. and Asia aren’t immune either. Economists at Barclays Plc and JPMorgan Chase & Co are amongst the ones decreasing forecasts for international boom and elevating them for purchaser prices. Both anticipate growth approximately a percent factor weaker and inflation a percent factor more potent than previously.

“Soaring commodity prices and increased risk aversion caused by the Russia-Ukraine war imply a stagflationary shock,” the Barclays economists led by Christian Keller wrote in a report. “While Europe looks more vulnerable than the U.S., and the U.K. is somewhere in between, China seems least exposed.”

Stagnation would exacerbate the trade-offs between expansion and inflation. Governments are under pressure to offset the pain with increased spending, such as subsidies, to protect the poor from high energy bills. ready to raise interest rates.

“The Fed has no choice but to hike in March, and we believe they will keep hiking beyond that despite the geopolitical risks,” Jefferies economists Aneta Markowska and Thomas Simons said in a report. “A 7- hike scenario still seems like a reasonable base case.”

The International Monetary Fund warns of the “very serious” economic consequences of the war. Analysts at Goldman Sachs Group Inc. estimate that a prolonged $20 oil price shock will reduce gross domestic product by 0.6% in the euro zone and 0.3% in the United States and China. The disruption to gas supplies by Ukraine could cut euro-zone GDP by 1%, while a complete loss of Russian gas would mean a loss of 2.2%, the economists added. Oil exports to the USand Europe would reduce global GDP by 3 percentage points.

Other than Russia, Ukraine and neighboring economies in Europe’s east, euro-region international locations seem maximum at risk. Based on assumptions of power charges at their new highs reached on Monday, Bloomberg Economics’s SHOK in-residence version of the euro-region economic system confirmed a contraction withinside the 1/3 region and 6% inflation this year.