The best gold ETF in the world sees its holdings increase in bullish demand SignGold has just received a very bullish signal from investors who are returning massively to the precious metal.

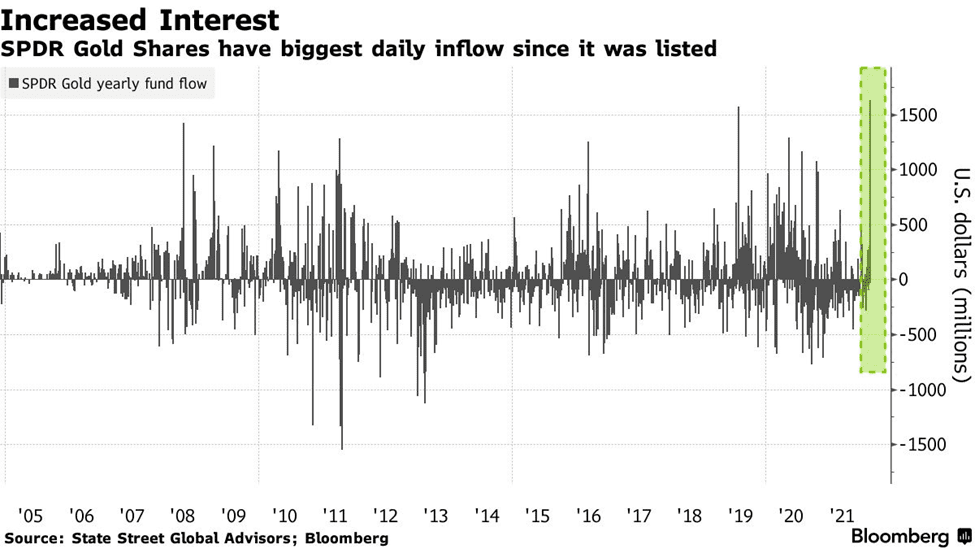

SPDR Gold Shares, the largest bullion-backed exchange-traded fund, posted its largest net dollar inflow since its listing in 2004 on Friday at $1.63 billion. Changes in ETF holdings are monitored as an indicator of investor interest in long-term gold betting.

Holdings fell in 2021, a lackluster year for gold prices. The jump comes ahead of the pivotal Federal Reserve meeting this week, which economists say will signal an early March for rate hikes.

Even as the Fed prepares to tighten, which could dampen the appeal of non-interest-bearing bullion, demand for the sky is supported by falling stocks, US tensions over Ukraine and falling Bitcoin .

In tonnage terms, Friday’s net inflow was 27.6 tons. Meanwhile hedge funds trading the Comex cut back their bullish bets to a five-week low in the week through to last Tuesday.

“We find it very surprising that the gold price has failed to profit from the robust ETF inflows,” Daniel Briesemann, an analyst at Commerzbank AG, wrote in a note. “This week will presumably see market participants focusing mainly on the meeting of the U.S. Fed”

Gold has had an insignificant 2021 after hitting an all-time high in 2020. As global central banks begin to scale back pandemic-era stimulus and the omicron variant of Covid19 is less damaging than expected, the Investor enthusiasm for precious metals has waned.

Last year, the SPDR Gold ETF recorded its biggest annual outflow by tonnage since 2013. Bullion fell 0.2% on Monday to $1,832.22 an ounce at 10:34 a.m. New York. the dollar was rising. Silver and platinum fell, while palladium gained.